What happens when a nonprofit’s board member – the one who set up the organization’s PayPal account – moves away without notice, and steals the donations from the end-of-year campaign? What happens when a nonprofit’s social media accounts are locked up by a former disgruntled employee who keeps posting bad information, and no one knows the passwords?

These are just a few real, nonprofit disasters that take place every day across the U.S. Although small nonprofits may be most vulnerable to fraud due to lack of proper infrastructure and limited staffing where volunteers are doing most of the work, ALL nonprofits need appropriate systems in place to mitigate risk, ethically and credibly raise funds, and gain full confidence from donors.

Fiscally accountable nonprofits need:

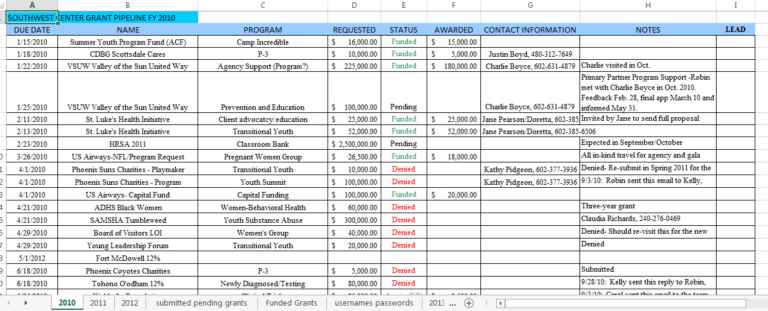

- Internal controls or financial management practices that are systematically used to prevent misuse and misappropriation of assets, such as occur through theft or embezzlement. This could include dual signatures required for writing checks over a certain amount, and having more than one person with access to banking, donor payment and social media accounts to prevent fraud. While an organization’s social media accounts should be managed tightly to control messaging and branding, more than one executive-level employee should be appointed as an administrator to protect from devastating hijackings, rogue postings, and account lock-ups. See this article.

- An accounting structure and the appropriate software to establish systematic recordkeeping. According to the nonprofit-focused donor records company Blackbaud, accounting software can:

- Drive different business processes, such as grant and endowment management.

- Ensure donor and grant restrictions and intent are met.

- Provide internal accountability to safeguard assets.

- Make timely financial information readily available to donors and prospects.

- Provide actionable data to managers to use in strategic decision making.

- Demonstrate accountability to multiple stakeholders—donors, volunteers, the public, and state and federal agencies.

- An appropriate donor database for organizing and centralizing donor data. There are a variety of donor database software systems that help fundraisers keep accurate donor records as well as information about each donor. See this article.

- Donor stewardship best practices to follow and demonstrate transparent, ethical and responsible use of donor investments. Donor stewardship includes a process for timely and formal thank-you letters, donor reporting, and ongoing donor recognition. See this article.

- Board policies to clearly spell out norms and expectations for the Board to provide the highest level of service to support the mission of the organization. Such board policies typically include a board give-or-get policy, a board conflict of interest policy, and a board ethics policy. You can find great templates online, as well as excellent resources here.