When my book featuring a “Career Portfolio” approach was published by Cengage in three languages and distributed globally, I asked questions that today are still rarely asked! That is: How well-diversified is your career? Are you putting all of your investments of time and effort into one job, or one skill set? Or, are you making investments in other career assets that enable you to grow your “career wealth” over time?

Taking a career investment approach in similar fashion to building a financial portfolio, I continue to share how readers can ensure career investments made today will provide a more purposeful and joyful career experience while minimizing exposure to marketplace risk. I also show how building a “CareerPortfolio™” can maximize the opportunity to make a purposeful difference through volunteerism.

According to my readers’ reviews on Amazon.com, Building Your CareerPortfolio could be called “finding your life purpose” – that it’s not just enough to have a job and work hard anymore. You must do something you love, participate in your community and continue learning throughout your life.

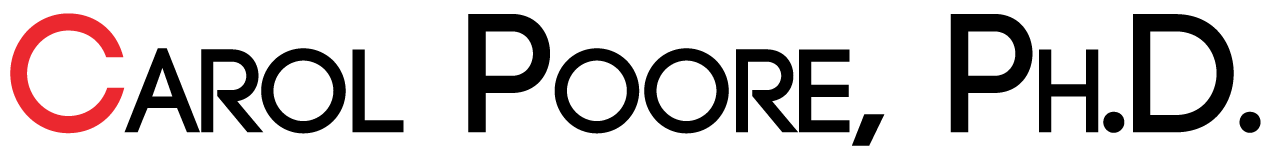

Guided with a personal purpose as the career investment strategy, the four career investments include pursuing a Primary Income Investment, developing one or more Secondary Income Investment(s), integrating one or more Volunteer Investment(s), and continuing to build knowledge through Lifelong Learning Investment(s).

The very first step to building your CareerPortfolio is to develop a personal purpose statement – or investment strategy. See this article for a brief overview. A short list of pivotal questions will lead you to develop your investment strategy, understanding themes in your life that create purpose and drive important career investments that you will undertake.

Then, your first career investment — your Primary Income Investment – can be aligned to support your purpose. For most of us, this is the job where we spend most of our work-focused time. Or, it could be your business if you’re an entrepreneur. A primary income investment is similar to a “blue-chip stock” – it’s relatively stable and brings a significant stream of benefits over time.

The second possible career asset comes in the form of a Secondary Income Investment. This is a separate business, a consulting project, or even a hobby owned by you, the career investor, for which there is a paying market for that product or service. The secondary income investment is similar to having a higher-risk/higher-return stock. While not everyone is geared up to becoming an entrepreneur, many are very capable of taking on an independent consulting project from time to time.

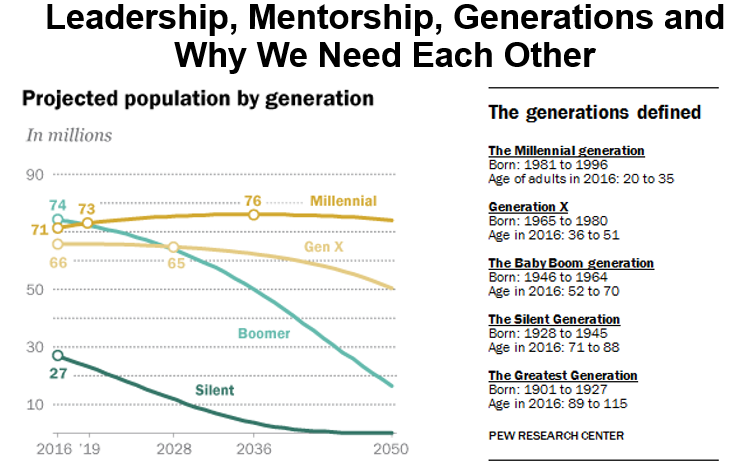

The third career investment is focused Volunteerism aligned with personal purpose. Strategic volunteer investments can serve as “career secret weapons,” because you can connect with incredible people that you otherwise may not normally meet. Those who volunteer are much less likely to be laid off during work force reductions (Wollebaek, & Selle, 2002). Why? Because these are the people who have cultivating valuable networks – exceptional social capital vital for any business or organization.

The fourth and final career investment is Lifelong Learning, aligned with personal purpose. This can include formal training, internships, reading about a topic over a period of time to become a topic expert, and mentorship. As a career investment, lifelong learning is similar to having cash in the bank, to be drawn upon whenever needed.

My premise in Building Your Career Portfolio, which stands as true today as when I researched and wrote the book, is that growing two or more of these four career investments, when strategically aligned with one’s personal purpose, can enable one to reap a more rewarding, exciting and flourishing career while making a purposeful difference in the world. Added return on investment includes flexibility to take advantage of new opportunities as well as the ability to personally weather a constantly changing work environment.

References and Resources

Poore, Carol A. (2001). Building Your Career Portfolio. Boston, MA: Cengage.

Wollebaek, D. & Selle, P. (2002). Does Participation in Voluntary Associations Contribute to Social Capital? The Impact of Intensity, Scope, and Type. Nonprofit and Voluntary Sector Quarterly, 31(1), pp. 32-61.